What Should You Know about a Shareholder Agreement?

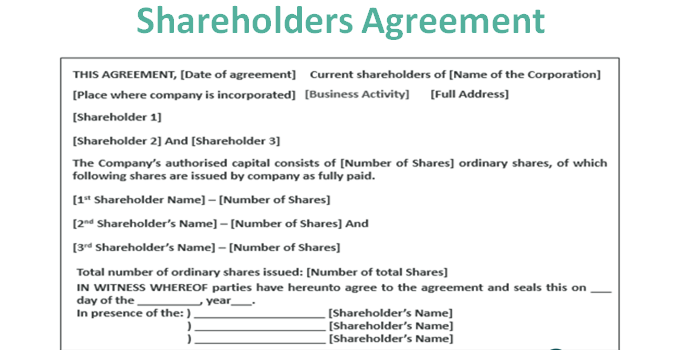

A shareholder is a person who invests money into the organisation. For its exchange, the organisation gives him a specific number of shares in the company. With these shares, the shareholder becomes one of the company owners. Thus, the shareholder also has the right to vote on specific matters associated with the company. You can buy a shareholder’s agreement template in which you insert the party’s names and addresses. The shareholders and the company should also sign it. You then get a Word copy of this agreement and then download it. The agreement is formatted in column form, so it’s highly readable. The shareholder’s agreement defines the obligations and rights of the shareholders and provisions associated with the management and the company’s authorities.

What Does a Shareholder’s Agreement Includes?

A shareholder’s agreement includes many things like the shareholder’s rights, regulations according to the salient transfer of the company’s share, and valuation methods for the shares.

Shareholder’s rights

Shareholder’s rights include the following:

- The right to command a general meeting

- The right to appoint certain directors

- The right to install a company auditor

- The right to have financial statements of the company

- The right to examine registers of the company

Regulations as per sale and transfer of the company’s share

With regards to the issue of share transfer to safeguard the interest of the shareholders, specific rules are organised. These rules ensure that a transfer occurs only after the consent of the involved parties.

The company’s financial requirements

The shareholders have the company’s financial statements. So they can track the organisation’s progress and its needs. If they find a requirement for an influx of funds, which will be advantageous to the company’s growth, they’ll discuss the most suitable source of funding and work toward acquiring it.

Requirements regarding a quorum

Quorum implies the minimum number of members needed for a meeting to be called a valid meeting. The requirements regarding it are clearly outlined in the shareholder’s agreement.

Valuation methods regarding the company’s shares

If the market fluctuates, the share value of the company also differs. But to assist in correctly preparing the financial statements, the approach to value the company’s shares is also essential. The valuation methods include the following:

- Income approach

- Assets approach

- Market approach

Points to Consider while Creating a Shareholder’s Agreement

There are several points you must note when drafting the agreement. These are as follows:

- It’s necessary to know the reason behind a shareholder’s agreement. You must have a balance of interests.

- The terms of the agreement you draft must be precise and clear. It will prevent any confusion.

- You must specify the obligations and rights of the shareholders and the company concisely.

- The agreement should be airtight. It should reflect the mutual benefit of the shareholders and the organisation.

- There must be brief processes and guidelines in the agreement. There’s no point elaborating on the policies and procedures and making them difficult to understand.

- The points you write in the agreement should be as per relevant laws in your area.

You can also use theshareholder’s agreement template, which works in any territory or state. They are prepared by well-qualified lawyers and barristers and are correct in every sense. You can also view a sample document before purchasing, and if you are not satisfied with a specific one after purchasing, you can return it within seven days.

For more valuable information visit the website